According to the, the American Angel Survey[1] the typical angel investor has a portfolio of just seven companies.

This despite a general perceived wisdom and ‘best practice’ requires that they should spread their money across at least ten different companies. The probability is that any one investment will result in a loss. Data suggests that as many as 70% of Angel backed companies fail to return capital (not all of the 70% enter liquidation. The worst ones continue to hang about the portfolio as zombies, sucking the time and reputation of their investors for no return).

The majority of investors in the UK are also not following this advice. The UKBAA and British Business Bank reported that 42% of Angel investors have ever only made five or fewer investments in their portfolio[2]. 64% have made ten or less (56% of those survey had five or more years’ experience as an active investor).

Equity Crowdfunding investors do even worse. Crowedcube notes that their average investor has a portfolio of just 2.4 investments[3].

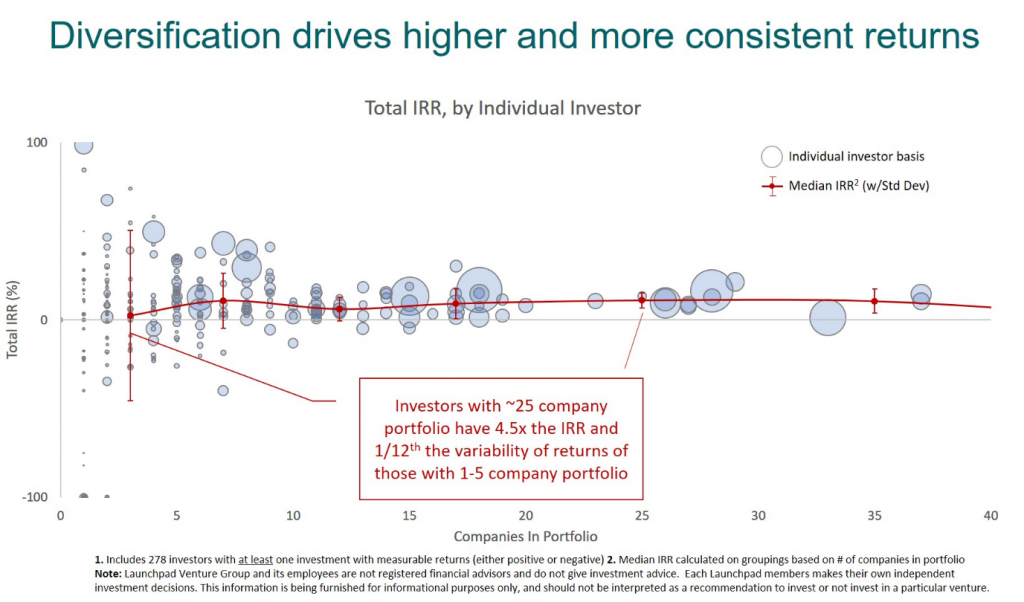

But it turns out that while the typical angel investor is not following perceived best practice, even to do so, and have a portfolio of 10, is not sufficient to properly diversify risk and maximise returns. Launchpad Venture Group (https://www.launchpadventuregroup.com/analysed) anonymized individual investment returns for 278 individual Launchpad members over the past 20 years. They looked at their current Total IRR (including both realized and unrealized returns). The results highlighted the need for a diversified portfolio, and showed that to maximise returns more than 10 investments are needed.

Individual returns from investing in only one or two companies ranged from +100% to -100%. Median returns for such portfolios were relatively low, and the standard deviation of returns dwarfed the median return, meaning you are about as likely to lose money as make money this way. It seems that the return on such portfolios is largely driven by pure luck.

Increasing the number of companies in a portfolio to 5-10 bumped median IRR up by a factor of 3-4x. Only a few individuals suffered aggregate portfolio losses with this level of diversification. More is definitely better.

Real diversification however takes more than the 10 companies of conventional wisdom. it is only once you get beyond 15-25 companies in the portfolio that median IRR comes out at around 4.5x what it was with just 1-4 companies.

So – 4.5 times better return if you have a portfolio of 15-25 companies rather than just 1-4.

How do you build a portfolio of 15-25?

- Work with an angel group, and create large syndicates at the first round.

- Even if just one or two of you could do the deal – open it up to a wider initial investor base. Don’t invest £100,000 by yourself in round one – invest £10,000 with 10 friends.

- Follow in with additional funding into those that are actually crating value. Remember it’s your ownership percentage at Exit, not round one, that will drive your returns. So, keep 4 times your initial investment for follow on.

- Accept that some companies will fail – and let them do so without wasting more time or cash on them. Divert that cash to new investments – and sustaining to good ones.

[2] The UK Business Angel Market, UKBAA, British Business Bank, 2018.

[1] http://media.wix.com/ugd/ecd9be_8e208b2da3e343509cd4957fb9521b27.pdf

[3] https://www.crowdcube.com/explore/blog/investing/invest-in-a-range-of-businesses-today